Retirement Distributions After a Divorce

We understand that divorce under any circumstances can be difficult and painful. In the case this process calls for the division of a participant’s retirement assets, the Board of Benefits Services seeks to provide services that will ease some of the burden of the complexity and expense involved. A case of a divorce settlement requiring the separation of retirement assets in either the RCA 403(b) Retirement Program or the RCA Retirement Plan will be handled directly through Fidelity. Contact Fidelity at 800-343-0860 or go to Fidelity’s QDRO Center Website (Qualified Domestic Relations Order) at: qdro.fidelity.com

A participant’s retirement funds may be in the RCA 403(b) Retirement Program, the RCA Retirement Plan, or both. If a participant’s funds in the RCA 403(b) Retirement Program are to be divided they may only be assigned by a Qualified Domestic Relations Order (“QDRO”). If a participant’s funds in the RCA Retirement Plan are to be divided they may only be assigned by a Domestic Relations Order (“DRO”).

Upon learning of an impending divorce, the Board of Benefits Services or Fidelity will freeze the participant’s retirement account(s) from any distributions until the required assets are transferred to the former spouse per the QDRO for the RCA 403(b) Retirement Program and/or DRO for the RCA Retirement Plan. Though the freeze is temporary, this is standard procedure to ensure appropriate administration of the court order.

Benefits of the QDRO Center Website

- QDRO Center Website is fast and simple to use

- By creating an account, Plan sponsors, participants, alternate payees, and respective counsel can easily access the site

- Smart way of creating a court-ready domestic relations order to avoid costly attorney legal fees

- Access and print the Plan’s QDRO Guidelines directly from the website Access and print the Plan’s QDRO Guidelines directly from the website

- Create a courtready domestic relations order that is in accordance with ERISA, the Code and the Plan’s QDRO Guidelines in 15 minutes or less

- Easy access to frequently asked questions and glossary of terms pertaining to the QDRO process

- Helps reduce common errors, producing orders that are more frequently qualified

403(b) Retirement Program

The RCA 403(b) Retirement Program is subject to specific Internal Revenue Code (“IRC”) rules. The IRC requires RCA 403(b) Retirement Program assets to be held for the exclusive benefit of the participants and the participant’s beneficiaries. Unless specifically authorized by the IRC, a participant cannot assign, alienate, or pledge his or her assets to a third party. Section 414(p) of the IRC allows RCA 403(b) Retirement Program funds to be distributed to alternate payees (including a former spouse) by a Qualified Domestic Relations Order (“QDRO”).

If the alternate payee is entitled to all or a portion of the participant’s RCA 403(b) Retirement Program funds, the alternate payee can choose one of two options:

- A full payout to a non-retirement account, subject to a 20% federal tax and state tax withholding.

- A rollover (either directly or indirectly) to an eligible retirement plan, including an IRA, with no tax consequences until the alternate payee begins to take retirement distributions.

Fidelity Investments will report the transaction on form 1099-R. Rollovers, while not taxable, are reported on form 1099-R.

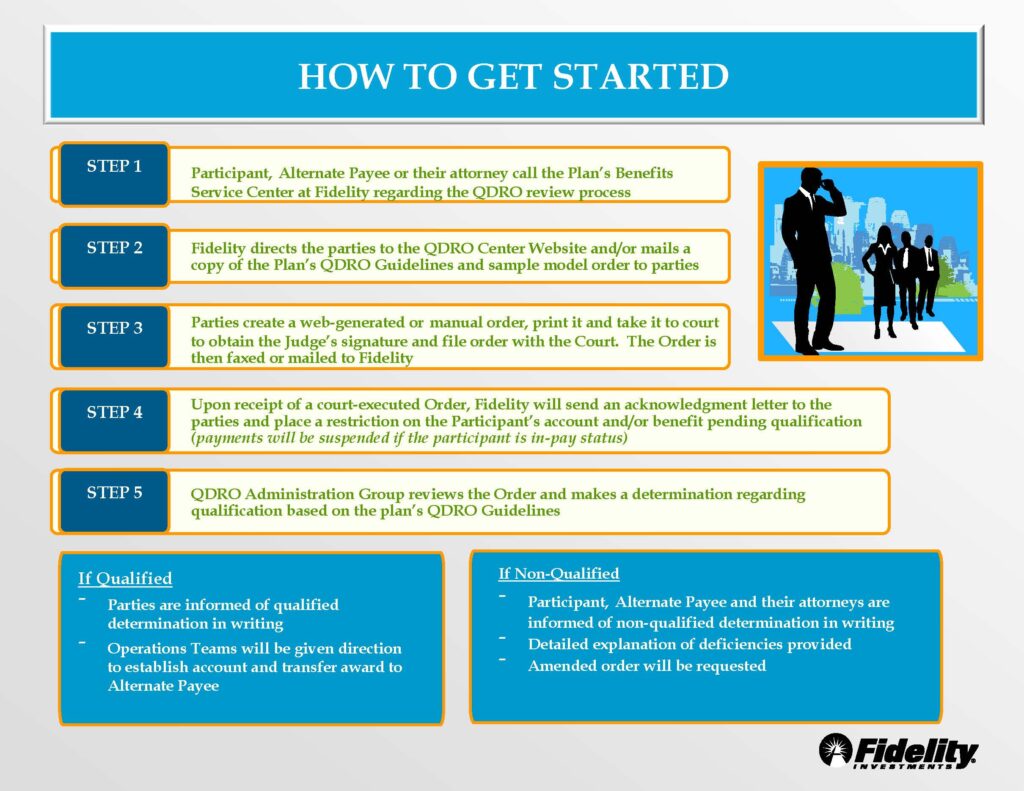

To initiate a QDRO either contact Fidelity at 800-343-0860 or go to Fidelity’s QDRO Center Website at: qdro.fidelity.com

RCA Retirement Plan

The RCA Retirement Plan is a nonqualified deferred compensation plan. The RCA Retirement Plan contains spendthrift provisions which generally prevent a participant from alienating, selling, anticipating, commuting, pledging, encumbering or assigning any plan benefit or payment, either voluntarily or involuntarily. As part of a divorce settlement, the plan allows a participant to authorize the payment of benefits directly to the nonparticipant ex-spouse in a lump sum distribution. The laws governing the division of a nonqualified retirement plan vary from state to state. The divorcing parties should consult their legal advisors in order to determine the amount, if any, of a participant’s assets to be assigned to the ex-spouse in divorce and the tax consequences to each party.

If the alternate payee is eligible for all or a portion of the participant’s plan, the alternate payee is only able to receive a full payout of the assigned assets. A full payout means that the alternate payee will receive the full distribution as a taxable transaction with automatic federal and state withholding. Because the RCA Retirement Plan is not considered an eligible retirement plan under the Internal Revenue Code, any amounts payable from the plan cannot be rolled over on a tax-deferred basis into another eligible retirement plan or IRA. The amount of the payout will be reported as “Other Income” in the tax year received on Form 1099-MISC.

To initiate a DRO either contact Fidelity at 800-343-0860 or go to Fidelity’s QDRO Center Website at: Qdro.fidelity.com

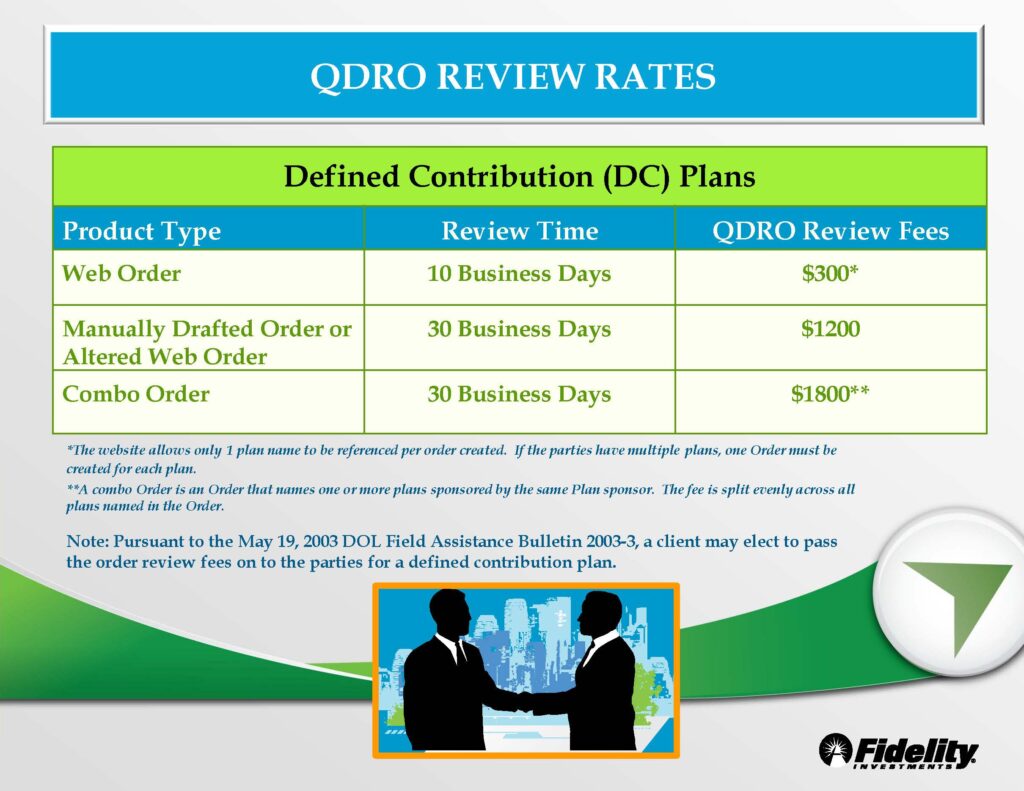

Fees for participants with funds in one or both plans

When the parties use Fidelity’s QDRO website to draft an order, it allows them to name only a single plan per order. The review fee for a QDRO website generated order will be $300 if the order is not materially altered; if altered, the fee will be $1,200. All fees are deducted directly from the RCA 403(b) Retirement Program. Likewise, if the participant only has funds in the RCA Retirement Plan, the parties may use Fidelity’s QDRO website to draft an order for a DRO. The review fee for a website generated order will be $300 if the order is not materially altered; If altered, the fee will be $1,200. All fees are deducted directly from the RCA Retirement Plan.

In the case a participant has both plans and each plan is subject to QDRO division and each plan is submitted separately then the fee is $300 per order as a review fee. The total fee will be $600.

If a single order names both plans, the review fee will be $1800 and the fee will be evenly split between the plans.

Have a question?

We are here to help!

Board of Benefits Services

475 Riverside Drive, Suite 1606

New York, NY 10115

retirement@rca.org

866-221-5480