When I want to make healthier changes in my life, I often employ the “go big or go home” strategy. I want to make the change in a way that is unique and interesting, and, more importantly, in a way that will produce a big change quickly. The hard truth is that most of these changes start with a bang but quickly fizzle out and are forgotten.

The most powerful changes in my life have been small, healthy changes spread out over a long period of time.

During a long road trip over the holidays, I listened to the audiobook Atomic Habits by James Clear. His premise is that tiny changes, applied strategically, can help provide remarkable results. As he makes his case through research and storytelling, he focuses on the idea that improving yourself by just 1 percent over and over again can help lead to significant change over time.

Ministers often feel financially stretched thin, and putting aside extra funds for retirement seems unrealistic. If we’re honest, the reality of the rising cost of groceries, the needs of our children, and unexpected medical events can make it seem as though clergy (and others) are stretched to the limit.

The power of 1 percent

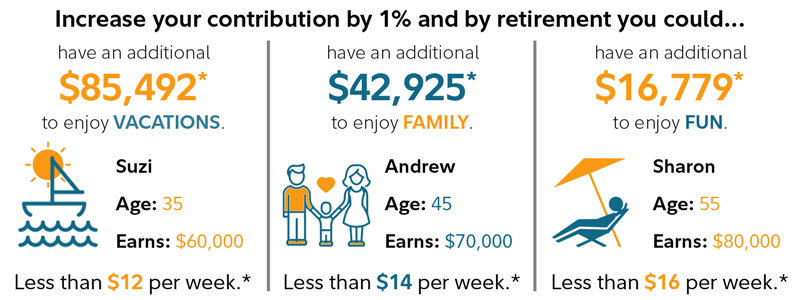

What would it be like to set aside 1 percent of your salary toward your retirement savings? Maybe your knee-jerk reaction is that you don’t have extra funds to set aside, and even if you did, 1 percent won’t have much of an impact. Let’s take a look at the numbers.

Can I afford to save more?

For a minister making $60,000 a year, setting aside 1 percent of their salary would be $600 annually. If that minister receives 24 paychecks per year, 1 percent comes out to $25 per paycheck. But it gets better. Because a contribution to your RCA 403(b) plan lowers your taxable income, it will actually be less than $600 out of your pocket each year. For a minister living in Michigan who is in the 12 percent tax bracket, it would only end up being about $21 less in each paycheck. Not unrealistic, right?

Will that really have an impact?

Remember how those little 1 percent changes over a period of time can provide remarkable results? Look at this infographic provided by Fidelity to see the impact of an additional 1 percent of savings.

This information is intended to be educational and is not tailored to the investment needs of any specific investor

To see how your retirement savings might grow by making small changes to your contributions, check out the “power of small amounts” tool on their website.

Rinse and repeat

When a healthy change is small, easy, and effective, we are likely to repeat the habit. RCA Ministers serving a congregation receive a contribution equal to 11 percent of their salary into their 403(b) account. If you increase your contribution by 1 percent every year for four years, you’d have the equivalent of 15 percent of your salary going toward retirement investments each year. This is what most financial planners say is the target for a retirement where your needs are met and your dreams are realized.

Consider giving the 1 percent increase a try this year. If you’re an RCA Minister enrolled in the RCA 403(b) plan, it’s easy to log into your NetBenefits account and start making contributions today.